When it comes to exploring financial options for individuals with bad credit, catalogues are often overlooked but can be a valuable resource. Catalogues for bad credit offer a way for individuals to shop for essential items and pay for them over time, regardless of their credit history. These catalogues typically have more lenient approval processes compared to traditional lenders, making them a viable option for those struggling to obtain credit elsewhere. By understanding the ins and outs of catalogues for bad credit, individuals can take advantage of this alternative form of financing to meet their needs.

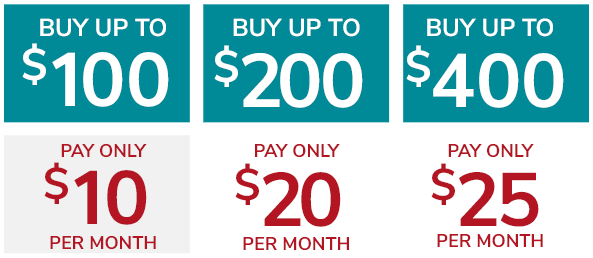

One key feature of catalogues for bad credit is that they often do not require a credit check for approval. This can be appealing to individuals with a poor credit history or no credit history at all, as it provides them with an opportunity to access essential items without the fear of being denied due to their credit score. Additionally, catalogues for bad credit typically offer flexible payment options, allowing individuals to spread out the cost of their purchases over a period of time. In the next section, we will discuss the key takeaways when considering catalogues for bad credit, including how to apply, what to look for in a catalogue, and tips for managing payments effectively.

key Takeaways

1. Catalogues for bad credit provide a convenient shopping option for individuals who may have difficulty obtaining credit elsewhere, allowing them to purchase items and pay for them over time.

2. These catalogues typically do not require a credit check, making them accessible to those with poor or limited credit history.

3. It is important for consumers to carefully consider the terms and conditions of catalogue credit, as they may come with high interest rates and fees that can add up quickly if not managed properly.

4. By using catalogues responsibly and making timely payments, individuals can improve their credit score over time and potentially qualify for better credit options in the future.

5. Prior to applying for a catalogue, it is advisable to research different catalogues to find the one that best suits your needs and offers favorable terms.

What are the Best Catalogues for Bad Credit?

How Catalogues for Bad Credit Work

Catalogues for bad credit are essentially shopping platforms that allow individuals with poor credit scores to purchase items on credit. These catalogues offer a range of products from clothing and electronics to home goods and appliances. Customers can select items they want, add them to their cart, and check out with the option to pay in installments.

Benefits of Catalogues for Bad Credit

One of the main benefits of using catalogues for bad credit is the opportunity to rebuild your credit score. By making timely payments on your purchases, you can demonstrate responsible financial behavior and improve your credit standing over time. Additionally, these catalogues often offer exclusive discounts and deals to customers with bad credit, making it easier to save money on essential purchases.

Considerations When Choosing a Catalogue

When exploring your options for catalogues for bad credit, there are several factors to consider. Look for catalogues that report your payment history to credit bureaus, as this can help improve your credit score. Additionally, pay attention to the interest rates and fees associated with each catalogue, as these can vary widely and impact the overall cost of your purchases. If you’re interested in finding catalogues that meet these criteria, you may want to check out https://thepromenaderhyl.co.uk/.

Types of Catalogues for Bad Credit

There are several types of catalogues specifically geared towards individuals with bad credit. Some catalogues may require a credit check, while others operate on a buy now, pay later model with no credit check necessary. It’s important to find a catalogue that aligns with your financial situation and offers products that meet your needs.

What are the Best Practices for Using Catalogues for Bad Credit?

1. Make timely payments to improve your credit score.

2. Compare interest rates and fees before making a purchase.

3. Only buy what you can afford to pay off to avoid falling into more debt.

FAQs

Can I get a catalogue with bad credit?

Yes, there are catalogues specifically designed for individuals with bad credit. These catalogues offer options for shopping and purchasing items on credit, even if you have a less than perfect credit score.

Will applying for a catalogue affect my credit score?

Applying for a catalogue may result in a hard inquiry on your credit report, which could have a temporary impact on your credit score. However, responsibly using the catalogue and making timely payments can actually help improve your credit over time.

Are there fees associated with using a catalogue for bad credit?

Some catalogues for bad credit may have fees such as annual membership fees or high interest rates. It’s important to carefully review the terms and conditions before signing up for a catalogue to understand any potential fees involved.

Can I return items purchased through a bad credit catalogue?

Most catalogues for bad credit have return policies in place that allow you to return items within a certain timeframe for a refund or exchange. Be sure to familiarize yourself with the return policy of the specific catalogue you are using.

Is it possible to get approved for a higher credit limit on a bad credit catalogue?

Some catalogues for bad credit may offer the opportunity to increase your credit limit over time as you demonstrate responsible borrowing behavior. This typically involves making consistent on-time payments and managing your credit responsibly.

Can using a catalogue for bad credit help me rebuild my credit?

Yes, using a catalogue for bad credit can be a tool to help rebuild your credit if you make timely payments and manage your account responsibly. By demonstrating good borrowing behavior, you can improve your credit score over time.

What items can I purchase through a bad credit catalogue?

Bad credit catalogues typically offer a wide range of products, including clothing, electronics, home goods, and more. You can use the catalogue to shop for items you need and pay for them over time.

How do I qualify for a bad credit catalogue?

Qualification requirements for bad credit catalogues vary, but generally, you will need to be at least 18 years old and have a verifiable income. Some catalogues may also require a credit check, while others may not.

What happens if I miss a payment on my bad credit catalogue?

If you miss a payment on your bad credit catalogue, you may incur late fees and it could negatively impact your credit score. It’s important to make all payments on time to avoid these consequences and maintain a positive credit history.

Are there alternatives to using a bad credit catalogue?

Yes, if you’re concerned about using a bad credit catalogue, there are alternative options available such as secured credit cards, personal loans for bad credit, or layaway programs. It’s important to explore all your options and choose the best fit for your financial situation.

Final Thoughts

Exploring your options with catalogues for bad credit can be a helpful way to access financing for purchases and rebuild your credit history. By understanding the terms and responsibilities involved, you can make informed decisions that benefit your financial future. Remember to use these catalogues responsibly and make timely payments to improve your credit standing.

Overall, catalogues for bad credit can be a valuable tool for those looking to make purchases on credit, even with a less than ideal credit score. With proper management and responsible borrowing habits, you can use these catalogues to your advantage and work towards a healthier financial outlook.